ISEA is pleased to team with ArkMalibu to give members a snapshot of M&A activity in the PPE and safety equipment sector. After a slow start to the year, deal count and volume are expected to accelerate throughout 2024, thanks to:

- Significant cash reserves held by both strategic and financial buyers (nearly $2.6T for private equity alone)

- Rising confidence in economic conditions (click here for the latest forecasts from ITR Economics)

- Increasing spend on domestic infrastructure

As a result, valuation multiples are also expected to increase. Click here to read the full Snapshot (members only).

EOY 2024 as M&A volume is driven by strategic buyers carrying excess cash. Moreover, consistent with 2023, inflation and interest rate risk will drive valuation multiples up for premium middle-market companies as strategic and financial buyers target acquisitions within this range.

As governments continue to invest money into domestic infrastructure, demand for PPE & industrial safety equipment is projected to increase as a by-product of larger projects.

This comes at a time when both administrations have plans to continue to invest growing amounts into domestic infrastructure. The rise of demilitarization and increasing geopolitical tensions have also increased the need for safety equipment for first responders, resulting in

federal investments and contracts that serve as tailwinds for increases in M&A activity within the industry.

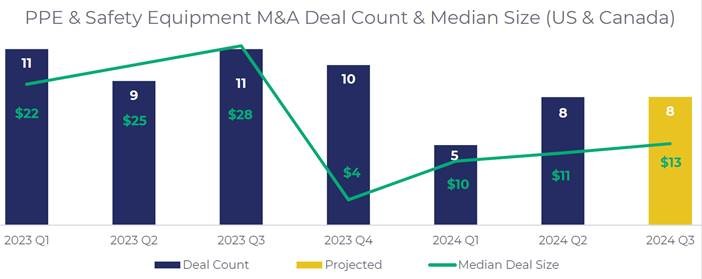

These factors will continue to push large safety equipment players to small and medium size acquisitions as indicated in the graph above. Additionally, PE deals accounted for ~50% of the industry deals in 2024, and when combined with a record-setting amount of private equity dry powder (capital that needs to be deployed) and the tailwinds described above, it is expected to continue driving heightened PPE & safety equipment M&A activity.

A relatively sluggish 2023, M&A deal volume across all U.S. industries is projected to rise 20% this year, according to the EY-Parthenon Deal Barometer.

The personal protective equipment (PPE) sector has experienced significant merger and acquisition (M&A) activity in 2024, driven by several key factors. As we progress through the year, the landscape for PPE and safety equipment companies is evolving, with strategic buyers leading the charge. This blog post delves into the current trends and future projections of M&A in the PPE industry.

Recovery and Growth in 2024

The PPE sector saw a recovery in M&A valuations in the second quarter of 2024, with a promising outlook for continued growth in the latter half of the year. This rebound follows a sluggish start in Q1, influenced by economic uncertainties and fluctuating interest rates. However, as recession fears abate, interest rates stabilize, and infrastructure spending rises, the M&A activity is expected to strengthen significantly.

Strategic and Financial Buyers

Strategic buyers, often with excess cash reserves, are actively seeking acquisitions to enhance their market position and diversify their product offerings. Financial buyers, including private equity firms, are also playing a crucial role. In fact, private equity deals have accounted for approximately 50% of the industry’s transactions in 2024. The abundance of private equity dry powder (capital waiting to be deployed) is a significant driver of this heightened M&A activity.

Key Acquisitions in 2024

Several notable acquisitions have already taken place this year, exemplifying the trend of consolidation within the PPE sector:

- Lakeland Industries Acquires Jolly Safety Footwear: In February 2024, Lakeland Industries, a US-based manufacturer of protective clothing, acquired Jolly Safety Footwear for $9.6 million. This acquisition strengthens Lakeland’s presence in the first responder footwear market and expands its geographic footprint in Europe.

- Cadre Holdings Acquires ICOR Technology: In January 2024, Cadre Holdings, known for its safety and survivability products, acquired ICOR Technology for $40.3 million. ICOR Technology, a supplier of explosive ordinance disposal robots, complements Cadre’s existing product offerings, particularly for military and EOD customers.

- Lawson Products Acquires Emergent Safety Supply: Also in January 2024, Lawson Products, a distributor of maintenance and repair supplies, acquired Emergent Safety Supply for $9.9 million. This acquisition allows Lawson to penetrate the PPE and safety supplies market, aligning with their goal of expanding into additional industrial segments.

Market Dynamics and Future Projections

The PPE market is poised for continued M&A activity driven by several factors:

- Infrastructure Spending: Government investments in domestic infrastructure projects are expected to boost demand for PPE and industrial safety equipment. These large-scale projects create a ripple effect, increasing the need for safety equipment across various sectors.

- Geopolitical Tensions: Rising geopolitical tensions and the push for demilitarization have increased the demand for safety equipment for first responders. This has resulted in federal investments and contracts, further propelling M&A activity.

- Valuation Multiples: Valuation multiples are trending upwards, particularly for premium middle-market companies. Strategic and financial buyers are targeting acquisitions within this range, driven by inflation and interest rate risks.

Conclusion

As 2024 progresses, the PPE sector is expected to see a robust increase in M&A activity. Strategic and financial buyers are actively seeking opportunities to expand their market presence and diversify their product offerings. With infrastructure spending on the rise and geopolitical tensions driving demand, the future looks promising for the PPE and safety equipment industry.

For companies in the sector, understanding these trends and preparing for potential M&A opportunities will be crucial in navigating this dynamic market landscape.